As an instructor here at CE Institute LLC, I recently had a poor massage experience that felt like an appropriate teaching moment. Without naming names, and while recognizing that massage is like ice cream flavors, some people may have different tastes, I felt it was important to document the experience here at so that practitioners could learn from it.

I went to a massage establishment where I have had reliably great massage appointments over the past year between two different therapists. Both therapists were not available for my next appointment during my rigid schedule, so the receptionist recommended that I try their lead therapist as a substitute. I agreed, and scheduled a 90 minute massage appointment which is what I standardly book.

Everything was perfectly normal when I arrived. The establishment was tidy and clean. The staff were pleasant and professional. I was taken for my appointment on-time. Unfortunately I already had a slight headache when I arrived, but I figured that's a great time to receive a massage! Massage has regularly helped relieve my headaches, so I felt this was perfect timing.

.

The therapist didn't really ask much about my headache, and instead simply instructed me to lie face down in the face cradle to start the 90-minute appointment. She seemed to approach the appointment in some form of cookie-cutter style where everyone gets the same thing, and according to her, she starts all of her appointments with back massage and the client pronated.

.

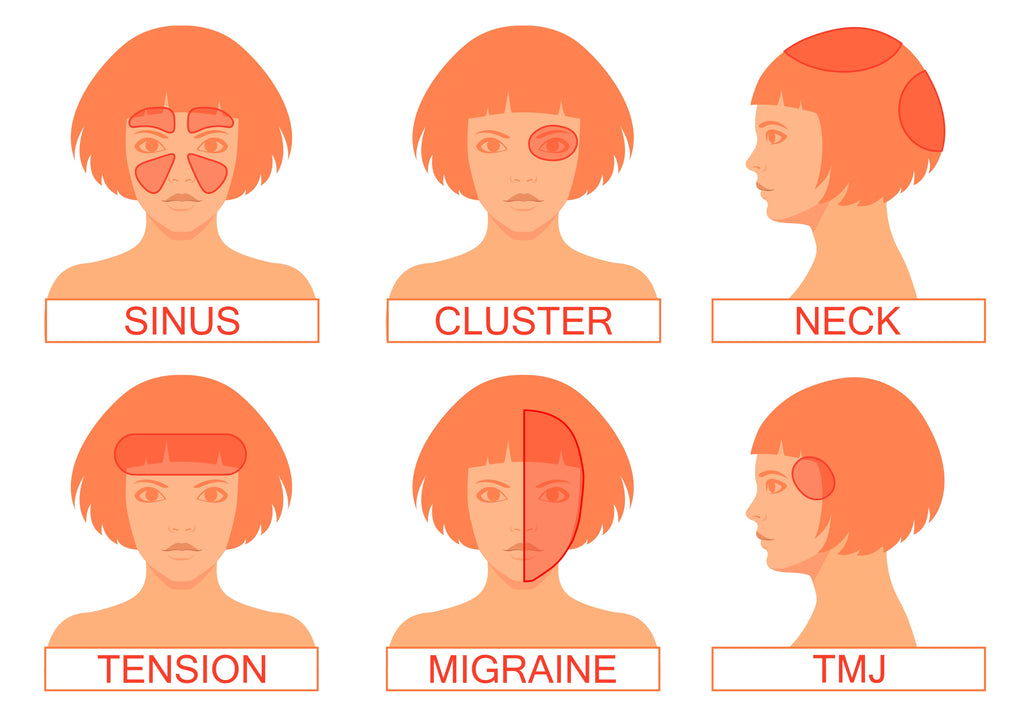

My headache was likely due to allergies, as I had some serious sinus pain, so lying face down in the face cradle wasn't appealing to me, but I did it anyway to simply observe what this lead therapist would do next. I figured she might have some amazing trick or technique and I was willing to go along with her instructions, to a point.

.

She also had the table warmer on, but because I'm menopausal, I asked her to remove the top blanket covering the sheet because I was way too hot with the table warmer. This was the first thing we did when she reentered the room.

Once she removed the blanket, she then put what felt like a heavy towel over my head while I lay pronated, struggling to breath in the face cradle with a growing sinus-type headache. It was astonishing to me that someone would cover my head with a heavy towel, despite knowing I was already too hot and suffering from head pain.

.

In my opinion as a massage instructor, this is a perfect example where a therapist is simply doing what they do to all clients in a "cookie-cutter style massage", regardless of the client's individual medical presentation.

.

After the therapist removed the towel from my head at my request, she then started a back massage. She completely ignored my headache, while I continued suffering in the pronated position in the face cradle.

.

The back massage began with what felt like a firm patting session with lotion. She would perform a stroke from either top to bottom or bottom to top, and while she had wonderful contact, when she reached the end of the stroke, she broke contact, lifted her hand off my body, and placed her hand back at the start of the last stroke and repeated this over and over again, until she moved onto the next stroke. The constant broken contact literally felt like I was being patted like a dog, instead of receiving a massage. This went on for over ten minutes, until I finally said something with an increasing headache in the pronated position.

.

I told her I was uncomfortable with the pressure on my sinuses in the face cradle, and it felt like I had a very fast growing sinus headache. I requested to roll over into a supinated position, and perhaps even elevate my head a little above my shoulders to help the growing sinus pressure. I also asked her if she wouldn't mind performing some facial and scalp massage first, to try to relieve the headache, for which she agreed.

.

I do not want anyone to think we're writing about something trivial here - we'd just like to make the point that this felt like what some of us call a "cookie cutter" style of massage, where all clients are getting the same thing, without independent evaluation or a customized treatment for my medical situation, and it was pretty awful. By the time I rolled over on the table into a supine position, my head was pounding so badly that I had to get up. I was unable to finish receiving the massage because I had become nauseous and it started to feel like a roaring migraine. And while I can't say for medical certainty, I can say after decades of suffering with headaches and migraines, I likely escalated in pain so quickly due to the position I was placed in, without a second thought by this massage therapist.

.

In our teachings, we instruct massage therapists to ask the following type of questions when a client presents with a headache::

- What type of headache do you have? Do you know, or do they all feel the same?

- Are you taking any medication for your headaches?

- Where are you experiencing pain?

- Is there anything I can do to help you feel better?

- Where would you like me to start the massage?

- What position do you think you'd be most comfortable in?

Any of these questions could have helped the therapist help me. But she didn't do this. She simply did what she said she does with every other client, which is not the most effective method to execute a quality professional massage.

.

Obviously, I could have directed the therapist to do a better job than what she did; however, it's not the client's job to direct a therapist to do quality work. At no time should a therapist expect a client to tell them to do something that they should already know what to do. In fact, some clients might think the therapist knows best and simply follow their directions unquestioned, despite a deteriorating medical situation such as what I experienced. As such, it's critical for massage therapists to ask questions, and appropriately respond to answers and feedback.

.

A massage for a geriatric client, a massage for a professional athlete about to enter a sports competition, and a massage for a teacher with a sinus headache will all require something different. It's up to the therapist to determine what each individual client needs, and then execute a customized treatment plan for each individual client, even when it's just for one appointment. Afterall, this is the therapist's opportunity to acquire another client, because if she was able to appropriately treat my headache, I'd likely book another massage appointment when I had another headache.

.

Massage therapists must ask questions and determine what would be best for the client, rather than treat every client in the same manner. Not everyone is going to like the same exact massage, and in my particular case, it probably made me sicker than how I initially presented at the beginning of the appointment.

.

We understand that the massage therapy industry has a very high burnout rate; however, repeatedly providing the same thing over and over again, in some type of cookie cutter style treatment will likely add to that burnout feeling and effect. We are not robots, but when massage therapists behave like robots, and simply do overly repetitive work, it's no wonder that they would burn out from this. To avoid burnout and become a better practitioner, a massage therapist should always professionally interact with a client to determine their needs, and then provide a service that will truly benefit the client.

.

If clients wanted a one-style fits all cookie cutter approach, then they'd probably buy a massage chair from Sharper Image. Robotic massage equipment can provide the same treatment over and over again. Instead, most massage clients seek services from therapists for a more customized human experience, and we hope in sharing this experience, that is what more massage clients will hopefully receive.

.

This was written by CE Institute LLC staff. Names have been purposely ommitted to protect the privacy of all individuals involved.